- 2016 TAX EXTENSION FORM 2016 APK

- 2016 TAX EXTENSION FORM 2016 CODE

- 2016 TAX EXTENSION FORM 2016 DOWNLOAD

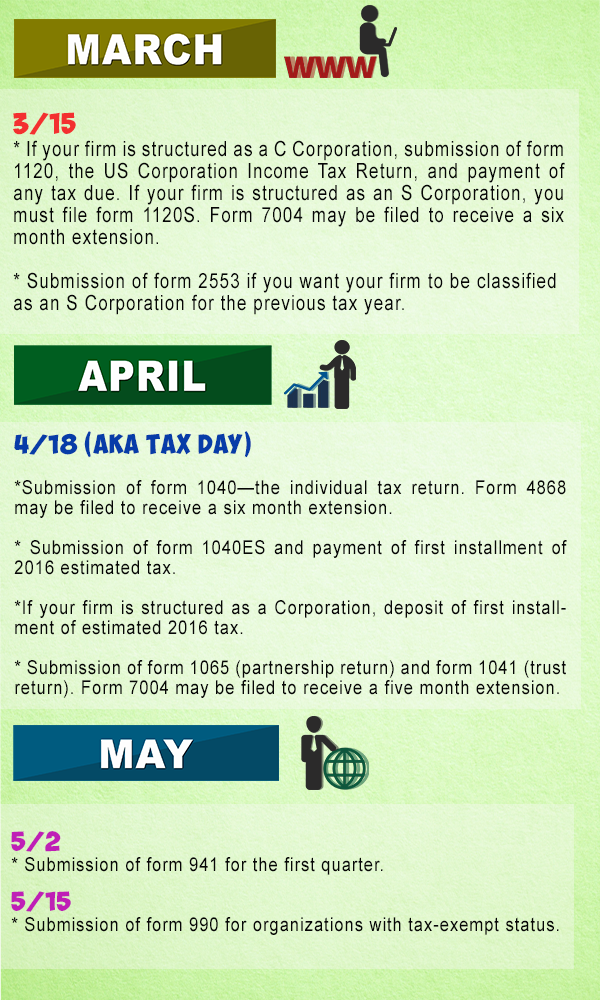

The interest and penalties will seem like nothing compared to the late filing penalties. If you are filing for any year other than through, indicate the year of the tax return with beginning and ending dates. The current tax year is 2021, with tax returns due in April 2022. W(week 1) and M(month 1) are emergency tax codes and appear at the end of an employee’s tax code, for example ‘577L W1’ or ‘577L M’.

2016 TAX EXTENSION FORM 2016 CODE

L is an emergency tax code only if followed by ‘W1’, ‘M1’ or ‘X’. For your convenience, provides printable copies of 42 current personal income tax forms from the Maryland Comptroller of Maryland. It’s used for most people with one job and no untaxed income, unpaid tax or taxable benefits (for example a company car). Select your state (s) and download, complete, print, and sign your 2016 State Tax Return income forms. To be perfectly clear, a tax extension gives you more time to file your return, but not to pay your taxes.įile even if you don't have the money The final point I'd like to emphasize is that you should always file your return on time, or request an extension, even if you don't have the money to pay. Maryland has a state income tax that ranges between 2.000 and 5.750. In order to file a 2016 IRS Tax Return, download, complete, print, and sign the 2016 IRS Tax Forms below and mail the forms to the address listed on the IRS and state forms. In the previous example of a $1,000 balance that's a year late, you would owe $30 in interest and $60 in penalties, unless you get it waived. Unlike interest, the late payment penalty can be waived if you can show good cause for not paying on time. 2016 Statement of Colorado Tax Remittance for Nonresident Partner, Shareholder or Member DR 0108 (07/27/15) Return this form with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. The late payment penalty is assessed in addition to interest and is 0.5% of any unpaid tax for each month or partial month it remains unpaid, up to a maximum of 25%.

2016 TAX EXTENSION FORM 2016 DOWNLOAD

Download E-File Tax Extension Form 8868 and enjoy it on your iPhone, iPad, and iPod. NOTE: The T16 file may also be used to create a backup of a tax return for archival purposes. T14 files store information for 2014 tax returns, and so on. T15 files store information for 2015 tax returns. T16 files store information for 2016 tax returns. So, if you owe $1,000 and pay a year after the deadline, you'll owe $30 in interest. Read reviews, compare customer ratings, see screenshots, and learn more about E-File Tax Extension Form 8868. The file extension appended on to H&R Block tax returns indicates the year of the return. The IRS's interest rate can vary, and is 3% for underpayments as of the first quarter of 2016.

2016 TAX EXTENSION FORM 2016 APK

You will owe interest on any tax not paid by the normal due date, even if you have a legitimate reason for not paying on time - such as being out of the country or some other hardship. E APK - file Form 4868 Personal Tax Extension 5 MB ( ) - ExpressExtension4868 APK - E-file Form 4868 Personal Tax Extension.

0 kommentar(er)

0 kommentar(er)